Examples

Step Three:

Design Your Custom Plan and Get Approved

Here are some ways we have helped clients design a plan for their situation. It is important to know when putting a long-term care plan in place that it is not necessarily “how much it costs.” Long-Term Care Insurance is about having a plan. First we look at your age and health to determine what options you can qualify for there. Then we look at how much benefit you want based on your goals, finances, and plans in retirement. Finally, we discuss the best way to fund your plan.

Future pricing is subject to change and the following examples may not be available due to carrier changes. However, once your plan is in place, there will be no changes to your plan.

Asset-Based Plans

Lifetime Benefit Plans

Husband, 62, and Wife, 60, make a single deposit of $208,306 into their plan which provides them with an unlimited long-term care benefit of $10,000 per month for each person. If both clients are on claim, they may draw up to $20,000 out of their plan tax-free for an unlimited amount of time. This plan also includes a second-to-die death benefit of $240,000 that will be paid to their beneficiaries if they never need long-term care.

| Year 10 | Year 20 | Year 30 | |

| Total Long-Term Care Benefit | Unlimited | Unlimited | Unlimited |

| Monthly Benefit Per Person | $10,000 | $10,000 | $10,000 |

| Tax-Free Death Benefit (return of premium) | $240,000 | $240,000 | $240,000 |

Note: This plan provides the clients with an unlimited amount of long-term care protection that can be accessed up to $10,000 per person for life. If they never need care, the death benefit will be paid to their estate. The policy can be surrendered at any time for the guaranteed cash value. There are no additional payments required for this plan.

Husband, 70, and Wife, 69, make a single deposit of $225,000 that is rolled out of an IRA and taxed over 10 years. This plan will provide each of them with a monthly long-term care benefit of $6,802 per month per person for an unlimited amount of time. The plan also guarantees at least $163,251 will be paid back to them or their estate in either long-term care benefits, death benefit, or both, tax-free.

| Year 10 | Year 20 | Year 30 | |

| Total Long-Term Care Benefit | Unlimited | Unlimited | Unlimited |

| Monthly Benefit Per Person | $6,802 | $6,802 | $6,802 |

| Tax-Free Death Benefit (return of premium) | $163,251 | $163,251 | $163,251 |

Note: Since we funded this with an IRA, the insurance company will set up another account that will fund the long-term care plan on their books over 10 years. The clients will receive a 1099R each of those 10 years in the amount of $28,125. This is the amount they will have to claim as income, not the initial roll-over amount. The insurance company is essentially giving a 20% bonus upfront. The clients could just keep their money in their IRA and pay the 10 annual payments of $28,125, but the insurance company will let them buy those payments for an upfront deposit of $225,000 and spread the taxes out over 10 years.

Husband, 68, and Wife, 66, make a single deposit of $195,007 into their asset-based plan. They will each receive a monthly benefit of $7,200 ($86,400 annually per person) for an unlimited amount of time should they need care. The plan also has a $172,800 guaranteed return of premium which is structured as a second-to-die death benefit. Both the husband and wife can pull out $7,200 a month for as long as they need it.

Year 10 | Year 20 | Year 30 | |

Total Long-Term Care Benefit | Unlimited | Unlimited | Unlimited |

Monthly Benefit Per Person | $7,200 | $7,200 | $7,200 |

Tax-Free Death Benefit (return of premium) | $172,800 | $172,800 | $172,800 |

Note: The death benefit means they are guaranteed to get $172,800 back in either long-term care benefits, tax-free death benefits, or a combination of both. So they will always get back what they put into the plan but they can pull out long-term care benefits for as long as they need without a limit. This protects their entire estate from an ongoing long-term care event.

Husband, 74, and Wife, 72, make a single deposit of $275,881 into their plan. This provides each of them with a monthly benefit of $8,000 for long-term care. This policy has an unlimited lifetime benefit of $8,000 a month for each of them. They may cancel the plan at any time for the cash surrender value and there is a second-to-die death benefit of $192,000 that will be paid to their estate if they never use the plan for long-term care.

Year 10 | Year 20 | Year 30 | |

Total Long-Term Care Benefit | Unlimited | Unlimited | Unlimited |

Monthly Benefit Per Person | $8,000 | $8,000 | $8,000 |

Tax-Free Death Benefit (return of premium) | $192,000 | $192,000 | $192,000 |

Note: Here is a great example of an older couple who were told they were too old for long-term care insurance and who thought they could only self-insure. By repositioning some of their savings into this plan, they are guaranteed to get a minimum of $192,000 back tax-free in either long-term care benefits, a death benefit to their estate or a combination of both.

Whenever you see a death benefit, the estate will get that amount minus any long-term care benefits paid. However, if they end up in an extended long-term care situation, they have an unlimited benefit that will pay each of them $96,000 a year for the rest of their lives. This is not a shared benefit for long-term care. They each receive up to $8,000 a month for life. There are no payments required and they are guaranteed to get more back than they put in, plus the benefits come back to them tax-free for long-term care and are not counted as income ever!

Cash Indemnity Plans

Female, 56, makes a single deposit of $127,168. This gives her an immediate benefit of $367,481 that she will be able to pull out at $4,734 a month. This plan will last her a minimum of 6 years once she is on claim. Both the monthly benefit and the total amount of coverage will grow each year by 3% compounded. The plan offers an immediate death benefit of $127,168. Even if she uses all of her long-term care insurance, this plan will still pay a guaranteed minimum death benefit of $22,725 to her beneficiary.

| Year 10 | Year 20 | Year 30 |

Total Long-Term Care Benefit | $479,480 | $644,381 | $865,994 |

Monthly Cash Benefit | $6,177 | $8,302 | $11,157 |

Tax-Free Death Benefit (return of premium) | $127,168 | $127,168 | $127,168 |

Note: This is a cash benefit plan so no receipts are required to receive her monthly benefit. Cash benefits can be used to pay for informal care. This plan also has a return of premium feature that grows each year and will return her full premium after 10 years if she cancels her policy.

*Guaranteed death benefit even if all long-term care benefits are used = $22,725

Female, 61, makes a single deposit of $133,794 into her plan which provides her with an initial long-term care benefit of $310,682 that she can pull out at a rate of $4,003 per month. The monthly benefit and total amount of coverage will grow by 3% each year. The death benefit guarantees her estate will get all of the money she puts into the plan if she doesn’t use it or only uses part of it. Also, if she does use all of the long-term care insurance, her estate will still get a guaranteed minimum death benefit of $25,066.

| Year 10 | Year 20 | Year 30 |

Total Long-Term Care Benefit | $405,369 | $544,782 | $732,142 |

Monthly Cash Benefit | $5,222 | $7,018 | $9,432 |

Tax-Free Death Benefit (return of premium) | $120,000 | $120,000 | $120,000 |

Note: This plan pays cash, which means she can use the funds tax-free to pay for informal or formal care. If she uses less than the death benefit for long-term care then her estate will receive the difference upon her death. However, she has a long-term care benefit that will pay out monthly for a minimum of 6 years.

*Guaranteed death benefit even if all long-term care benefits are used = $25,066

Female, 47, makes an initial deposit of $58,594 combined with 9 annual payments of $6,259 per year. She made the deposit to lower the ongoing payments. Her plan will provide her with an initial total long-term care benefit of $388,105 that she can access at a starting rate of $5,000 per month. This plan has a 3% compound growth rider that grows the monthly benefit and the total benefit each year. After all ten payments are made the policy is paid up in full and she has a full return of premium if she cancels, along with a $135,944 death benefit that starts year one.

| Year 10 | Year 20 | Year 30 |

Total Long-Term Care Benefit | $506,389 | $680,545 | $914,596 |

Monthly Cash Benefit | $6,524 | $8,768 | $11,783 |

Tax-Free Death Benefit (return of premium) | $135,944 | $135,944 | $135,944 |

Note: This is an example of putting some money to work upfront and paying the remainder of the premium over time. She has full coverage from day one along with a guaranteed minimum death benefit of $24,000 that is paid out even if she uses all of her long-term care insurance. Long-term care benefit is cash, so she can pay for informal care with this plan as well.

*Guaranteed death benefit even if all long-term care benefits are used = $24,000

Savings Based Plans

Female 60, She wasn’t in the best of health and didn’t think there were any options for her. She made a single deposit of $100,000 into this plan. This gives her immediate leverage of $300,000 she can use for long-term care over a minimum of 72 months or 6 years. Giving her an initial monthly benefit of $4,166 should she need care. The $100,000 she deposited is still her money and will grow with some interest which will also grow her long-term care benefit. The current interest rate for her is at 4.5%.

| Year 1 | Year 10 | Year 20 |

Total Long-Term Care Benefit | $309,833 | $414,177 | $571,809 |

Monthly Benefit Per Person | $4,303 | $5,752 | $7,942 |

Initial Deposit/Death Benefit | $103,278 | $138,059 | $190,603 |

Note: This plan is a glorified savings account. Her deposit of $100,000 will earn interest. The Long-term care benefit is paid for by a small percentage out of the earned interest based on her age. The excess interest then grows her initial deposit as well as her long-term care benefit. This plan can not go down in value. Although there is a small surrender charge if she cancels her policy in the first 10 years. She can access 10% annually without penalty from her initial deposit if she needs it.

*Numbers in chart show best case scenario interest rates at 4.50%

Husband 74, Wife 72, He had been turned down for coverage previously due to his health. We were able to get them both covered under this joint plan. They made a single deposit of $200,000 into this plan giving them $600,000 of long-term care coverage. This gives them each an initial monthly benefit of $6,895 for a minimum of 90 months or 7.5 years (It would be half that time if both were on claim using the monthly benefit). The $200,000 is still their asset and will grow with interest overtime, simultaneously growing their long-term care benefit.

| Year 1 | Year 10 | Year 20 |

Total Long-Term Care Benefit | $620,530 | $839,970 | $1,175,916 |

Monthly Benefit Per Person | $6,895 | $9,333 | $13,066 |

Initial Deposit/Death Benefit | $206,843 | $279,990 | $391,972 |

Note: The numbers shown in the chart are based on the 6% interest rate and best case scenario. Although the interest rate may change each year, the value in the plan can never go down. Although there is a small surrender charge if they cancel their policy in the first 10 years. they can access 10% annually without penalty from their initial deposit if needed.

*Numbers in chart show best case scenario interest rates at 6.00%

Female 62, makes a single deposit of $180,000 into her plan. She had inherited some money and wanted to use a portion of it to leverage into long-term care coverage if she ever needed it. This provides an immediate long-term care benefit of $562,360 which can be used over 6 years. If the client passes away, her estate will receive the cash value minus any long-term care benefits paid.

| Year 1 | Year 10 | Year 20 |

Total Long-Term Care Benefit | $562,360 | $810,221 | $1,215,662 |

Monthly Benefit | $7,811 | $11,253 | $16,884 |

Initial Deposit/Death Benefit | $187,453 | $270,074 | $405,221 |

Note: Her advisor had told her long-term care insurance was too expensive and she had enough assets to self-insure. She simply wanted the peace of mind knowing she had some coverage in place and if she didn’t need long-term care, this money simply went to her children. She also wanted the support long-term care insurance provides so her children have someone to call should she ever end up needing care.

*Numbers in chart show best case scenario interest rates at 5.50%

Traditional Plans

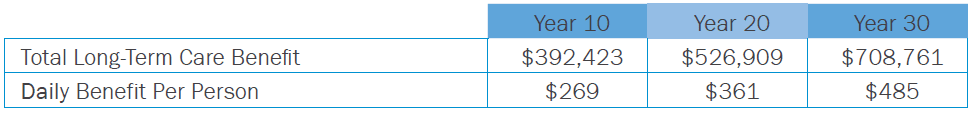

Female, 48, in excellent health, sets up a state partnership long-term care plan with annual payments of $4,055.65 which provides her with an initial benefit of $292,000. She can access this amount over a minimum of 4 years. This plan will grow by 3% each year which will also increase the amount she can access.

Note: Since this is a State Partnership Program, the client will be able to protect an amount of assets equal to what was paid out on her behalf and still qualify for Medicaid. This gives her an extra level of protection from a prolonged long-term care situation such as a cognitive issue. Once she goes on claim, she will stop paying premiums and start receiving her benefit.

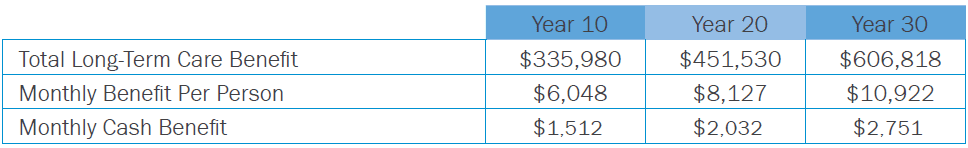

Husband, 58, and Wife, 57, set up a State Partnership Program for an annual payment of $6,596.77. The initial long-term care benefit is $250,000 and will grow by 3% each year. The clients can each access the plan as it is a shared care policy. Clients also have the option to choose 25% of the monthly benefit as a cash option (indemnity).

Note: This is a more flexible plan than most traditional plans since it has a cash option. This comes in handy as most long-term care situations start in the home and may not require the full monthly benefit that is available. Since traditional plans reimburse you for actual costs, by having a cash option the clients don’t have to wait to get reimbursed and they can spend the money as they see fit. Regardless of how they choose to draw out the money, the policy will pay out the entire long-term care balance.

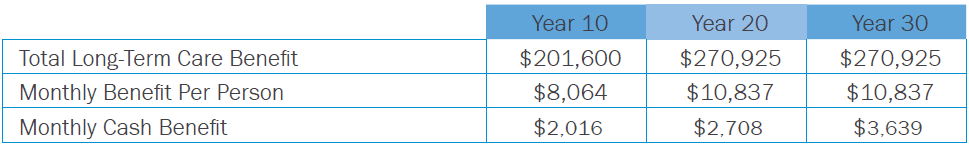

Female, 64, sets up a traditional State Partnership Plan with a monthly payment of $393.35. This provides her with an initial long-term care benefit of $125,000 that she can access up to $6,000 per month. The policy will increase 3% each year for the first twenty years.

Note: This policy provides the client with a meaningful amount of coverage but will also allow her to protect assets and still qualify for Medicaid should she end up in an extended long-term care situation. This plan fits financially for this client and has flexible options for drawing out the money, including an indemnity option.